Inside-Out and Bottom-Up: No Way to Design a Revenue Model

Quick, what’s the first question considered when pricing a new assignment? In most professional service firms, it’s undoubtedly “How much will this cost us?” More precisely, “How many hours will we spend on this?”

After decades of servitude to the hourly rate system, this way of thinking is now squarely embedded in the psyche of most professionals. As a group, professional service firms have never properly studied the discipline of pricing, so their approach is actually backward from how the rest of the business world approaches building a revenue model.

Pricing professionals start with the question, “What is the potential value of this product or service to the customer?’ From there, they set a target price based on the concept of willingness to pay (WTP). Only after the questions of value and price have been considered do modern companies then invest the time and resources in determining the cost. Cost estimating can be a tedious and complex exercise, so they set this question aside as the third step, not the first. What’s the point of a detailed cost estimate if the customer doesn’t see the value in the first place?

Price before cost

As Tim Smith, author of Pricing Done Right observes, “Leading firms price according to the customer’s willingness to pay, not the firm’s costs to produce.” Says Smith, “Customers and their needs are first and they define the price potential. Price is second and it defines the cost ceiling. Costs and operations are third and are designed to this the price and value goals. This is the opposite of letting costs define price. It is letting price define costs.”

By following this top-down process, you’ll be employing the kind of critical thinking and subjective judgement required for effective pricing decisions. Otherwise you’ll just be engaged in bottom-up costing, which isn't pricing; it's just cost accounting.

Another important paradigm shift requires that your pricing strategies be built from the outside-in, not inside-out. Peter Drucker taught that cost-based pricing is wrong for the simple reason that value doesn’t live inside the four walls of your company; it lives outside, in the marketplace, with customers. If we want to build a revenue model based on value, we have to look outside the company, because the only thing that lives inside the organization is costs.

When we remove our cost-driven blinders, an entire spectrum of pricing approaches emerges. In 1780s Vienna, the musical genius Wolfgang Amadeus Mozart conceived of an idea to help monetize his prolific output of new compositions: a subscription concert series. Today we see the subscription concept applied to software, cars (Volvo), fast food (Taco Bell) and yes, even professional services (law, accounting, and marketing firms).

Value is a judgment, not a calculation

The idea of subscribing to a taco generally doesn’t emerge from the finance department. Productive pricing strategies require imagination, innovation, and a great deal of subjective judgment.

Michelin’s idea of charging by the mile (rather than by the tire) for its commercial tire division was the result of ideation, insights, and customer feedback, not a spreadsheet generated by internal cost accountants.

In 1904, when King Gillette decided to introduce his new safety razor at a below-cost price, then charge a premium for the blades, he was employing a completely new pricing model that could never have emerged from a traditional cost-plus model.

In the context of professional services, estimating value requires an evaluation of the following questions:

Strategic importance. How important is this assignment in context of the client's overall strategic objectives?

Value horizon. Does this assignment have the potential to create long-term value for the client, or is it essentially tactical and short term?

Value classification. To what degree does this assignment require some form of specialized expertise, such as category expertise or high proficiency in a specific discipline or service area?

Unique qualifications. Is our firm uniquely qualified to perform this work, or could it just as easily be done by someone else?

Business impact. If we succeed in achieving the objectives of this assignment, will it create a significant financial impact for the client (either in terms of incremental revenues earned or operations costs reduced)? What is the value of positive changes in attitudes or behaviors among customers, channel partners, or employees?

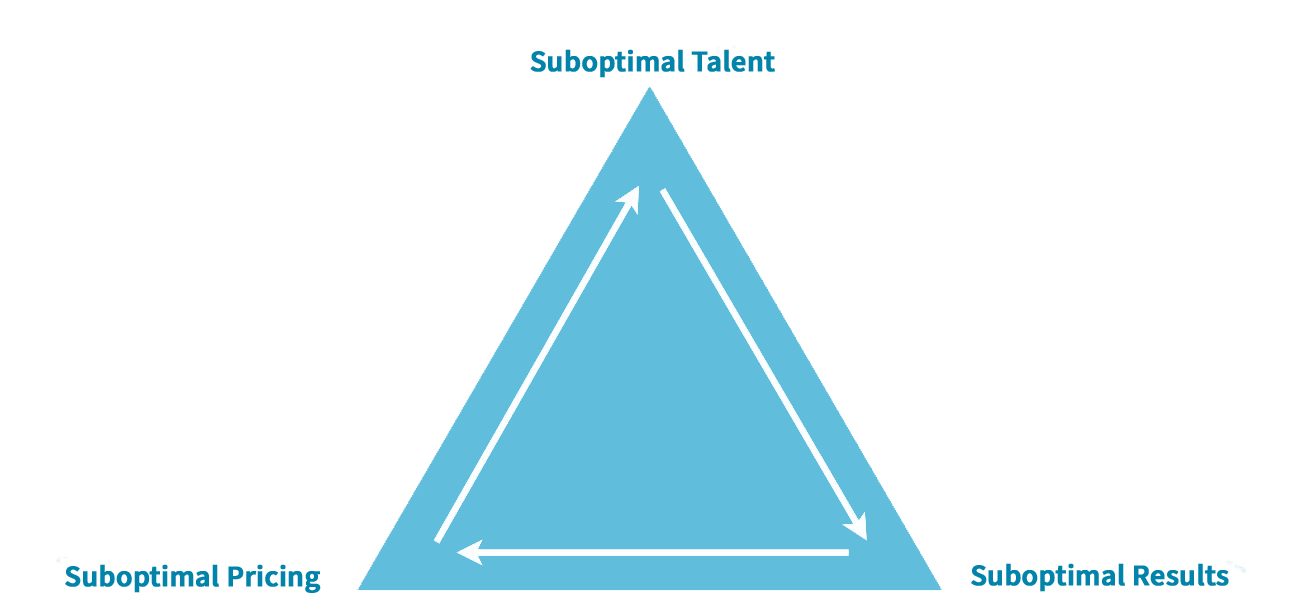

Many of the challenges faced by professional service firms today can be linked directly to having an upside-down, inside-out revenue model. Suboptimal margins make it chronically challenging to attract, pay and retain the best talent, creating a vicious cycle:

Fortunately there is a way out, and it starts with the creation of an actual revenue model (not just a cost structure) based on the value you’re creating for your clients, not the costs that you’re struggling to recover via the dead-end street called the hourly rate.